Federal and State Policy

As the largest US healthcare payer, the federal government plays a dominant role in shaping the healthcare marketplace, while states take center stage when it comes to developing novel policy approaches. Our experts track, interpret, and model policies that affect insurance coverage, access, and consumer choice so you can see around the bend.

Broader Federal Flexibility for Medicaid Expansion Rules Could Increase Coverage in Both Medicaid and Exchanges

If federal government permits states to expand Medicaid to only 100% of poverty, nearly 4M people could shift from Medicaid to exchanges, and 7M could be newly eligible for coverage.

Most Counties Will Have Free 2018 Exchange Plans for Low-Income Enrollees

New analysis from Avalere finds that nearly 98% of counties with exchanges operated by HealthCare.gov will have free bronze plan options for low-income consumers aged 50 earning 150% of poverty or less ($18,090 for an individual or $36,900 for a family of four).

Our Take on the NBPP Proposed Rule

This past Friday, the Centers for Medicare & Medicaid Services released the proposed Notice of Benefit and Payment Parameters (NBPP) for the 2019 plan year.

Impact Evaluation: Medicare Advantage Transition from RAPS to EDS

In February 2017, Avalere, an Inovalon company, analyzed data from eight Medicare Advantage Organizations (MAOs) representing 1.1 million beneficiaries in more than 30 unique plans operating across the country to understand the impact of shifting the determination of plan risk scores from the traditional Risk Adjustment Processing System (RAPS) to the new Encounter Data System (EDS).

Silver Exchange Premiums Rise 34% on Average in 2018

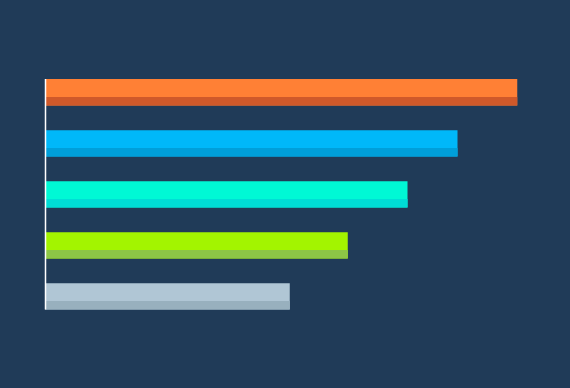

New analysis from Avalere finds that the 2018 exchange market will see silver premiums rise by an average of 34%. According to Avalere's analysis of filings from Healthcare.gov states, exchange premiums for the most popular type of exchange plan (silver) will be 34% higher, on average, compared to last year.

Uncertainty Reigns as Consumers Begin to Make Health Insurance Decisions for 2018

Avalere experts preview the 2018 ACA open enrollment season

Administration’s Decision to End Cost-Sharing Reduction Payments Will Lead to Substantial 2017 Losses for Health Plans

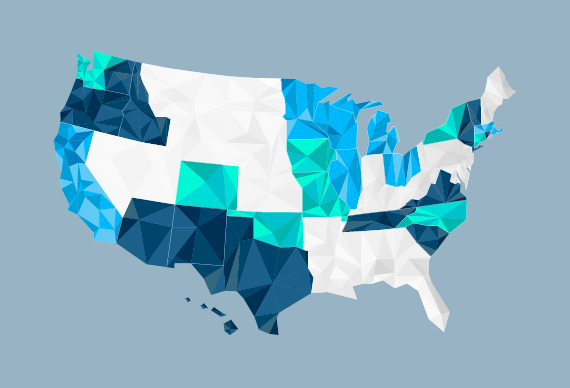

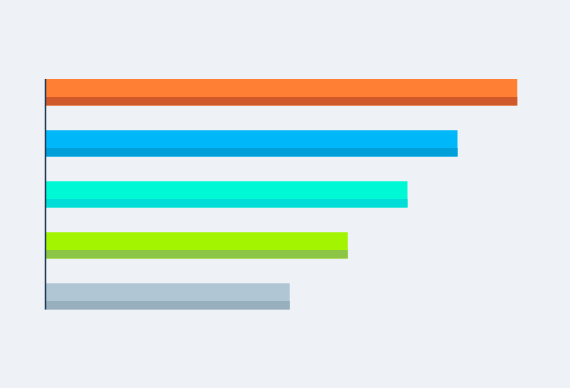

New analysis from Avalere finds that the administration's decision last week to end federal funding for the cost-sharing reduction (CSR) payments could lead to substantial losses for health plans-ranging from -$1.2M in North Dakota to -$200M in Florida through the end of 2017 (Figure 1).

Beneficiaries in Specialized Diabetes-Focused Medicare Plans Have Fewer Hospitalizations

Compared to beneficiaries with diabetes who are enrolled in other Medicare Advantage plans, enrollees in special needs plans experience better outcomes, after adjusting for demographic and clinical factors.

Avalere’s Take on the MA/PD Landscape Files Release

The Centers for Medicare & Medicaid Services (CMS) just released the annual Landscape Files containing data on plan participation, beneficiary premiums, and benefit designs for the 2018 Part D — Medicare's prescription drug benefit — and Medicare Advantage (MA) markets.

Updated Analysis: Revised Graham-Cassidy Bill Would Reduce Federal Funding to States by $205B

Avalere has updated its previous analysis to reflect the September 25 version of the Graham-Cassidy-Heller-Johnson (GCHJ) bill to repeal and replace the Affordable Care Act (ACA).

Graham-Cassidy-Heller-Johnson Bill Would Reduce Medicaid Funds to States by $713B Over the Next 10 Years

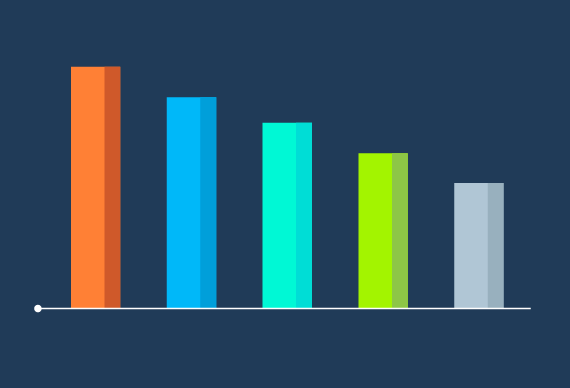

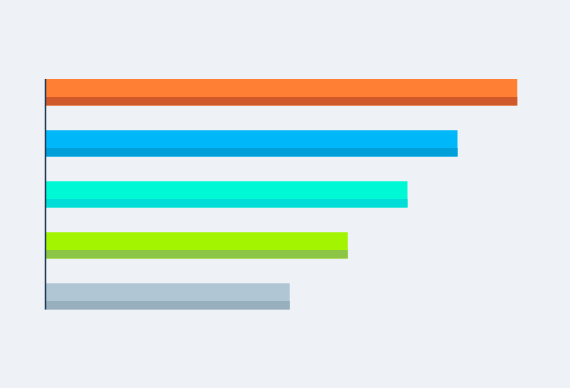

New analysis from Avalere finds that the Graham-Cassidy-Heller-Johnson (GCHJ) bill to repeal and replace the Affordable Care Act (ACA) would lead to a substantial reduction in federal Medicaid funding to states of $713B through 2026 and more than $3.5T over a 20-year period if block grant funding is not reauthorized (Figure 1).

Graham-Cassidy-Heller-Johnson Bill Would Reduce Federal Funding to States by $215B

New analysis from Avalere finds that the Graham-Cassidy-Heller-Johnson (GCHJ) bill to repeal and replace the Affordable Care Act (ACA) would lead to a reduction in federal funding to states by $215B through 2026 and more than $4T over a 20-year period (Table 1).

Exchange Reinsurance Stabilization Package Could Reduce 2018 Premiums by 17%

Market stabilization efforts could also lead to higher enrollment in exchanges.

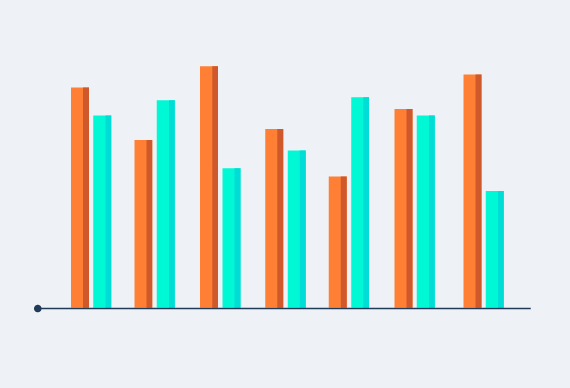

Exchange Plans in Counties with the Least Insurer Competition Have the Highest Premiums

Benefit designs do not vary widely based on insurer competition, except for deductibles that are lower in areas with three or more insurers.

Part D Premiums Update: What You Need to Know

On July 31, the Centers for Medicare & Medicaid Services (CMS) announced that the base Part D premium will be $35 for 2018.

Cruz Amendment to BCRA Would Lead to Coverage Losses and Increased Premiums for Individuals with Higher Medical Expense

Affordable Care Act-compliant plan market would see 39% higher premiums, while non–ACA-compliant plans would have much lower premiums

Elizabeth Carpenter to Present at NGA Summer Meeting

Elizabeth Carpenter, Senior Vice President, will present on July 15 at the National Governors Association Summer Meeting in Providence, RI, in a governors-only session entitled “The Future of Health Care.”

Update on The Medicare Trustee’s Report: IPAB Is Not Triggered

Today, the Medicare Trustees delivered to Congress their annual report on the financial operations and status of the program.

Medicaid Funding Reform: Impact on Dual-Eligible Beneficiaries

The Better Care Reconciliation Act (BCRA) would cap Medicaid funding to states. In this analysis, Avalere worked with The SCAN Foundation to examine how BCRA Medicaid changes would impact dual-eligible beneficiaries. We compare these outcomes to the impact of the House-approved American Health Care Act.

Senate Health Bill to Reduce Federal Medicaid Funding to States

New analysis from Avalere finds that states could see federal funding for their Medicaid programs decline by between 6% and 26% under the Better Care Reconciliation Act (BCRA) by 2026.